From Debt to Discharge: How SDS Supports Bankruptcy Attorneys in Guiding Borrowers Toward Student Loan Relief

- Dave Danielson

- Jul 14, 2025

- 2 min read

Updated: Jul 16, 2025

Though student loan discharges in bankruptcy have historically been rare, a shift is underway. The Department of Justice and Department of Education’s updated guidance in 2022 significantly lowered the legal and procedural barriers to discharging student loans through bankruptcy. Since then, bankruptcy courts have seen a gradual but consistent increase in filings seeking student loan relief, and approval rates are climbing. This growing wave presents an urgent opportunity for legal professionals—and a clear case for collaboration with Student Debt Solutions (SDS).

SDS has emerged as a data-driven ally to attorneys and their clients, delivering tools and analytics that clarify debt burdens, identify optimization paths, and support potential discharge candidates. Recent SDS analytics reveal that borrowers seeking help with their student loans span a wide financial range—from incomes under $18,000 to over $150,000—underscoring the growing complexity and widespread need for discharge assistance through bankruptcy.

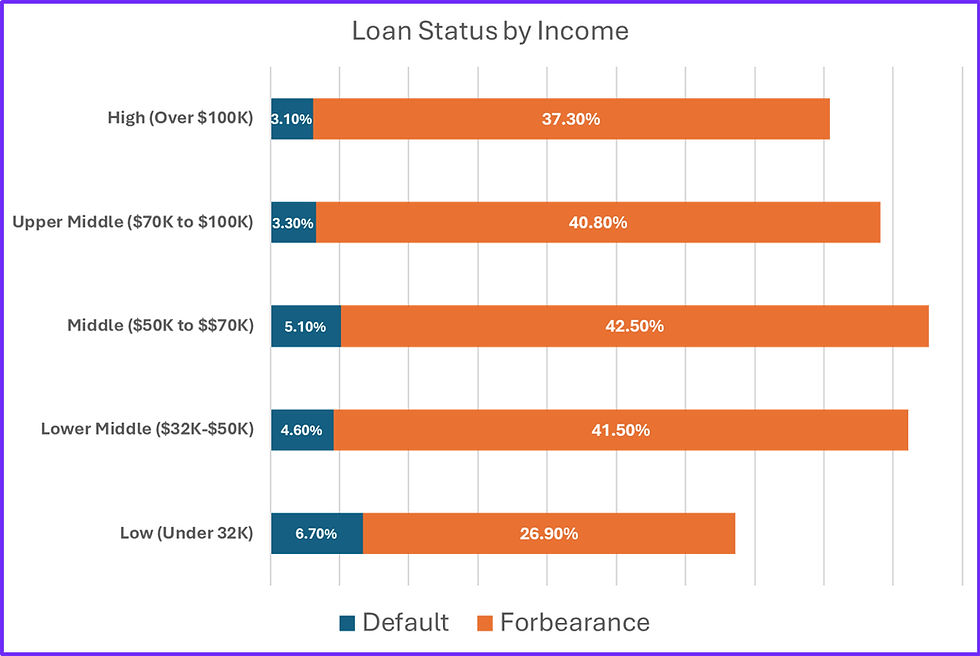

Many SDS users are already in distress: over 40% of Middle- and Lower-Middle income borrowers are in forbearance, and another significant portion are in default. There are now about 8 million borrowers in the SAVE repayment plan seeking lower payments. But, when the SAVE program ends, these borrowers will need to find another alternative to find student debt relief. These gaps often point to larger systemic misunderstandings or lack of access—areas where legal professionals can play a pivotal role.

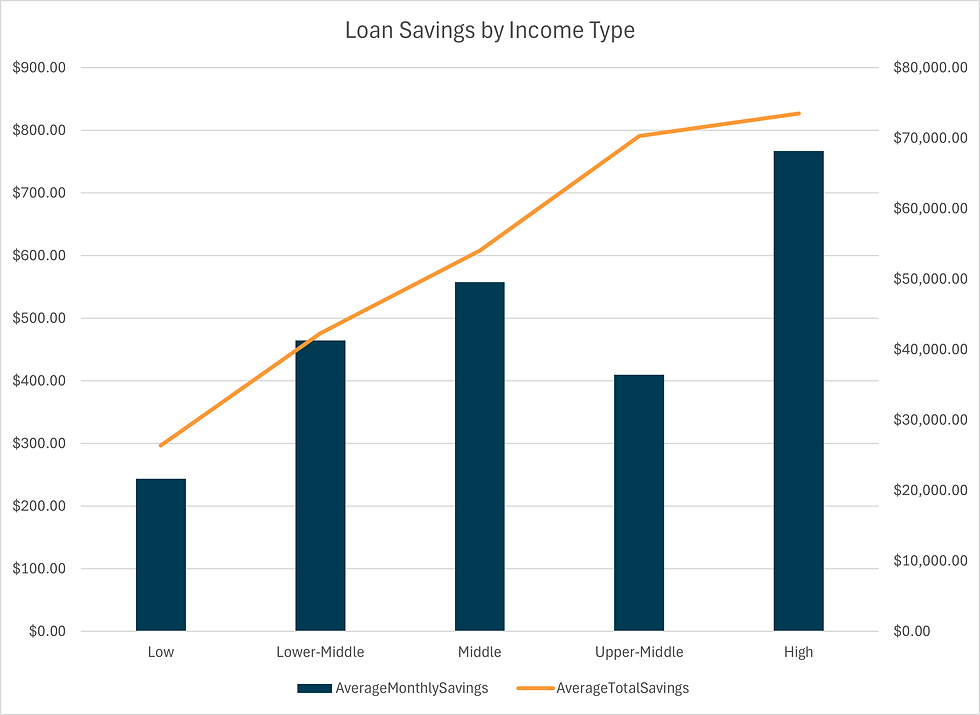

Importantly, SDS data shows substantial financial benefits when borrowers receive expert help. For high-income users, average monthly savings top $767, with total repayment savings exceeding $73,000. Even low-income borrowers benefit significantly, with an average of $244 saved monthly. However, these savings may still not result in payments that the borrowers can afford. When paired with strategic legal guidance, these savings can support a compelling hardship case under the DOJ’s new attestation process for bankruptcy discharge.

Attorneys partnering with SDS are equipped with key insights—such as loan summaries, income ranges, and SAVE plan usage—organized by loan type and filing status. This information helps guide repayment discussions and supports stronger discharge cases under today’s evolving standards.

As more borrowers turn to bankruptcy for relief and courts respond with more favorable outcomes, SDS is uniquely positioned to help attorneys bridge the legal-financial gap. Together, legal advocates and SDS can unlock real financial freedom for clients burdened by decades-old student debt.