Smart Tax Strategies for Student Loan Borrowers Using SDS

- Jennifer Duran

- Mar 17, 2025

- 2 min read

Updated: Mar 19, 2025

Tax season can be a stressful time, especially for student loan borrowers looking to optimize their financial situation. While student loans can impact your taxes in various ways, keeping track of payments, interest deductions, and repayment strategies can be overwhelming. Student Debt Solutions (SDS) provides valuable tools to help borrowers manage their loans effectively, ensuring they make informed financial decisions that can indirectly benefit their tax situation.

Key Student Loan Tax Benefits

Understanding the tax-related benefits of student loans can help borrowers make strategic financial choices:

Student Loan Interest Deduction – You may be eligible to deduct up to $2,500 in student loan interest paid during the tax year, lowering your taxable income.

Income-Driven Repayment (IDR) Plan Considerations – Your tax filing status (single or married filing separately) can impact your monthly loan payments under an IDR plan.

Loan Forgiveness and Tax Implications – Some forgiven loans are tax-free (e.g., Public Service Loan Forgiveness), while others might result in a tax liability.

SDS plays a crucial role in managing your loans effectively so that you can take advantage of these financial benefits.

How SDS Student Loan Software Helps Improve Your Financial Position

Tracking Loan Balances and Interest Accrued

The SDS platform provides a clear overview of your loan balances and the interest accruing on them. Having this information readily available makes it easier to determine potential deductions when filing your taxes.

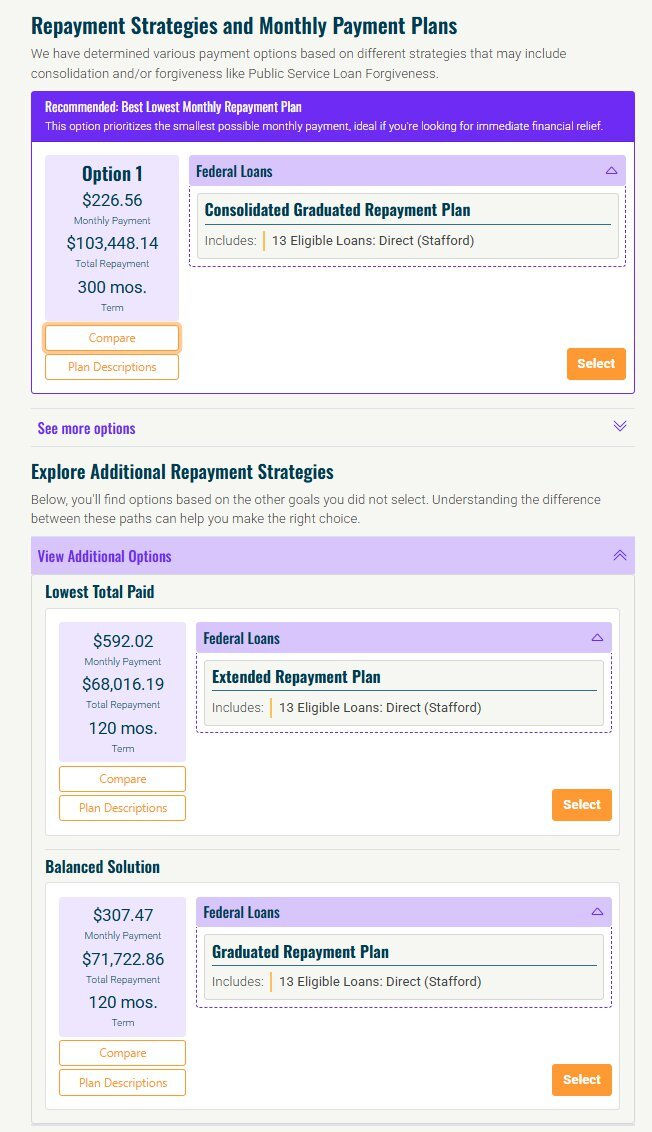

Helping Optimize Repayment Strategies

By analyzing different repayment plans, SDS helps you select an option that aligns with your financial goals. Choosing the right plan can impact your taxable income and cash flow, making tax season less stressful.

Assisting with Filing Status Considerations for IDR Plans

Borrowers on income-driven repayment plans may benefit from filing taxes separately to lower their monthly student loan payments. SDS allows users to simulate different repayment scenarios (like checking how different filing statuses impact your repayment plan/options), helping them make informed decisions before filing their taxes.

Preparing for Loan Forgiveness Tax Implications

Certain loan forgiveness programs could result in taxable income. SDS helps borrowers track their progress toward forgiveness, and plan for any potential tax liabilities when applicable.

Improving Overall Financial Organization

SDS helps borrowers stay financially organized. Having access to all student loan details in one place makes it easier to work with tax professionals or personally determine the impact of student loans on tax filings.

SDS is a valuable tool for managing student debt effectively and staying financially organized. It provides borrowers with the insights they need to make smart financial decisions that can impact their tax situation. By tracking loan balances, optimizing repayment plans, and helping borrowers understand the financial impact of their choices, SDS empowers users to take control of their student debt and maximize their overall financial well-being.

As tax season approaches, having a well-structured student loan strategy can help you avoid surprises and position yourself for financial success. Log into your account and explore your options today.