What the One Big Beautiful Bill Means for Student Loan Borrowers

- Melissa Maguire

- Jul 16, 2025

- 2 min read

On July 3, 2025, Congress passed the “One Big Beautiful Bill”, a sweeping piece of legislation that included significant updates to federal student loan repayment policy. While headlines have been quick to highlight major shifts, it's important to understand who these changes actually affect—and what remains the same.

Who Will this Affect?

The most significant changes will apply to new student loan borrowers—specifically, those who take out federal student loans on or after July 1, 2026. These borrowers will only have access to two repayment options:

A new fixed monthly repayment plan lasting 10 to 25 years

A new Repayment Assistance Plan (RAP), an income-driven option that caps payments between 1%–10% of discretionary income, with forgiveness after 30 years

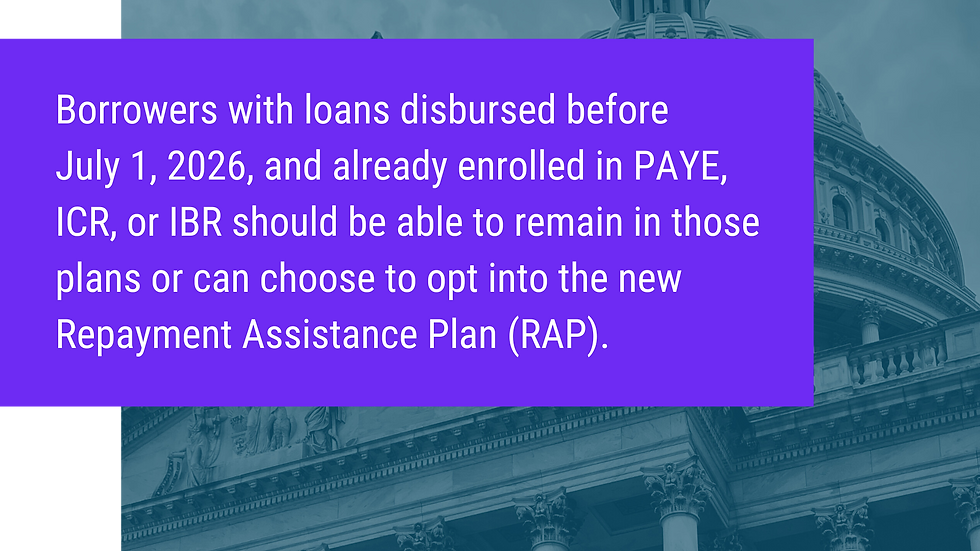

Borrowers with loans disbursed before July 1, 2026, are not required to switch to these new plans. Despite early drafts of the legislation proposing a mandatory “forced migration” of all borrowers into the new system, that provision was struck down by the Senate Parliamentarian. Because the bill passed through reconciliation—a process requiring only a simple majority—certain changes could not be included, preserving access to existing plans for current borrowers.

As a result, borrowers already enrolled in PAYE, ICR, or IBR should be able to remain in those plans or choose to opt into RAP only if they wish.

What About the SAVE Plan?

More than 7 million borrowers are currently enrolled in the Saving on a Valuable Education (SAVE) repayment plan, launched under executive authority by the Biden Administration.

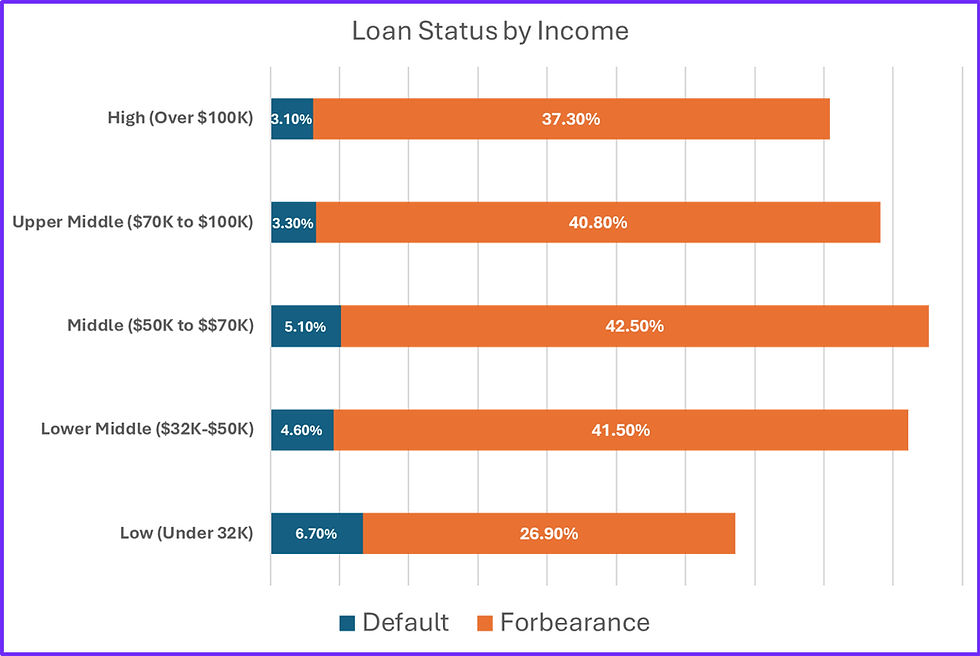

However, SAVE is now facing multiple legal challenges, and while the plan technically still exists, it’s currently frozen under court injunction. Borrowers enrolled in SAVE are not being removed from the plan, but:

Their loans are in administrative forbearance while the courts decide the program’s future

The 0% interest subsidy is ending on August 1, 2025

Beginning in August, interest will begin to accrue again—even while payments remain paused

Borrowers in SAVE should monitor their loan statements closely and consider whether switching to another available plan—like IBR—might help them avoid ballooning balances due to accumulating interest.

What Happens Next?

While the legislation is now law, we’re still awaiting technical corrections and agency guidance to clarify how implementation will unfold. Some sections of the bill may retain placeholder language until amended. The Department of Education will be releasing updated servicing and repayment rules over the next 12–18 months.

SDS will continue tracking those developments and ensure our platform reflects the most current repayment plan structures and borrower rights.

SDS Tip: Review, Don’t React

For now, most existing borrowers are not affected by these changes. If you’re already enrolled in a repayment plan—especially PAYE, IBR, or ICR—you do not need to switch plans. However, as interest resumes on SAVE and new repayment options emerge, it’s important to review your repayment strategy to ensure it still aligns with your income, goals, and forgiveness eligibility. If you have a free account with Student Debt Solutions, login to review your options.

SDS will continue to support you every step of the way with real-time updates, detailed repayment analysis, and expert support when you need it.